Most Recent CFA Institute CFA-Level-II Exam Dumps

Prepare for the CFA Institute CFA Level II Chartered Financial Analyst exam with our extensive collection of questions and answers. These practice Q&A are updated according to the latest syllabus, providing you with the tools needed to review and test your knowledge.

QA4Exam focus on the latest syllabus and exam objectives, our practice Q&A are designed to help you identify key topics and solidify your understanding. By focusing on the core curriculum, These Questions & Answers helps you cover all the essential topics, ensuring you're well-prepared for every section of the exam. Each question comes with a detailed explanation, offering valuable insights and helping you to learn from your mistakes. Whether you're looking to assess your progress or dive deeper into complex topics, our updated Q&A will provide the support you need to confidently approach the CFA Institute CFA-Level-II exam and achieve success.

The questions for CFA-Level-II were last updated on Mar 2, 2026.

- Viewing page 1 out of 143 pages.

- Viewing questions 1-5 out of 715 questions

Chris Darin, CFA, works as a sell-side senior analyst and vice president for a large Toronto brokerage firm researching mainly hedge funds and alternative investments. Darin recently hired Simon Nielsen for the position of junior analyst at the firm. Although Nielsen does not have experience evaluating hedge funds, Darin hired him mainly for his previous experience at a discount brokerage firm and for his passion for the industry. Darin frequently mentors Nielsen on market trends, investment styles, and on risks inherent in alternative investment vehicles. In a recent conversation, Darin makes the following statements:

Statement 1: One way to measure hedge fund investment performance is through Jensen's alpha. A portfolio with negative Jensen's alpha would plot above the Security Market Line (SML).

Statement 2: Both the Sharpe ratio and Jensen's alpha can be used to measure risk-adjusted hedge fund returns. Oneof the advantages is comparability between the two methods since both calculate return relative to systematic risk.

Their conversation later shifts to discussing hedge fund classifications and how derivatives affect hedge fund performance measurement. Nielsen mentions that put options are often more advantageous than short selling in a market neutral strategy because of their asymmetric returns.

The following week Darin asks Nielsen to research potential problems and biases in hedge fund indexes and general risks inherent in investing in hedge funds. Nielsen compiles the information and presents the following findings:

1. One of the data problems in hedge fund indexes is that managers often do not disclose negative fund performance.

2. The historical performance of hedge funds that are recently added to an index is often added to the past performance of the index.

3. Long/short equity hedge funds are subject to equity market risk. This risk is typically greater than with equity market neutral or risk arbitrage funds due to the higher standard deviations and market correlations inherent in long/short funds.

4. Fixed income arbitrage funds are also subject to equity market risk. These funds are short Treasuries and long high-credit-risk bonds. In an economic downturn the short position in Treasuries provides a buffer against the long position and provides a net gain.

Finally, the two discuss the risk-free rate and various risk measures in hedge fund performance evaluation. Darin explains that even in market neutral strategies, the risk-free rate may not be an appropriate measure of fund performance. Nielsen does not understand and asks him to clarify. Darin further states that risk measures such as Value at Risk have several limitations as a risk measurement tool.

Nielsen's findings on long/short equity funds and fixed income arbitrage strategies, respectively, are:

Nielsens finding on long/short funds is correct. Although equity market risk is inherent in most equity hedge fund strategies, long/short funds usually exhibit higher standard deviations and higher market correlations than equity market neutral or risk (merger) arbitrage funds do.

Nielsens finding on fixed income arbitrage funds is incorrect. The description of these funds is accurate in that fixed income arbitrage funds arc short Treasuries and long high-credit-risk bonds. In a market downturn, however, the loss in the short position in Treasuries typically outweighs the long position and creates a net loss for the fund. (Study Session 13, LOS 50.a)

Jason Bennett is an analyst for Valley Airlines (Valley), a U .S . firm. Valley owns a stake in Southwest Air Cargo (Southwest), also a U .S . firm. The two firms have had a long-standing relationship. The relationship has become even closer because several of Valley's top executives hold seats on Southwest's Board of Directors.

Valley acquired a 45% ownership stake in Southwest on December 31, 2007. Acquisition of the ownership stake cost $9 million and was paid in cash. Valley's stake in Southwest is such that management can account for the investment using either the equity method or the acquisition method. While Valley's management desires to fairly represent the firm's operating results, they have assigned Bennett to assess the impact of each method on reported financial statements.

Immediately prior to the acquisition. Valley's current asset balance and total equity were $96 million and $80 million, respectively. Southwest's current assets and total equity were $32 million and $16 million, respectively.

While analyzing the use of the equity method versus the acquisition method, Bennett calculates the return on assets (ROA) ratio. He arrives at two conclusions:

Statement 1: Compared to the acquisition method, the equity method results in a higher ROA because of the higher net income under the equity method.

Statement 2: Compared to the acquisition method, the equity method results in a higher ROA because of the smaller level of total assets under the equity method.

In order to get a better picture of Valley's operating condition, Bennett is also considering the use of proportionate consolidation to account for Southwest. He makes the following statements regarding the acquisition method and a proportionate consolidation:

Statement 3: Both methods are widely accepted under the provisions of U .S . GAAP and International Financial Reporting Standards (IFRS).

Statement 4: Both methods report the same level of assets on the parent's balance sheet.

Statement 5: Both methods report all of Southwest's liabilities on the parent's balance sheet.

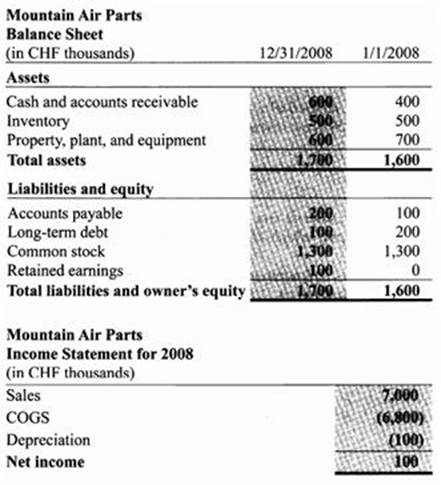

In addition. Valley has always wanted to pursue its goal of vertical integration by expanding its scope of operations to include the manufacturing of airline parts for its own airplanes. Therefore, it established a subsidiary, Mountain Air Parts (Mountain), in Switzerland on January 1,2008. Switzerland was chosen as the location for economic and geographical diversification reasons. Mountain will operate as a self-contained, independent subsidiary. Local management in Switzerland will make the majority of operating, financing, and investing decisions.

The Swiss franc (CHF) is the official currency in Switzerland. On January 1, 2008, the USD/CHF exchange rate was 0.77. At December 31, 2008, the exchange rate had changed to 0.85 USD/CHF. The average exchange rate in 2008 was 0.80 USD/CHF. In its first year of operations. Mountain paid no dividends and no taxes. Mountain uses the FIFO assumption for its flow of inventory.

The balance of Valley's current assets as of December 31, 2007, using the acquisition method, is closest to:

Consolidated current assets are equal to $119 million ($96 Valley current assets - $9 cash for investment in Southwest + $32 Southwest current assets). (Study Session 5. LOS 21.a)

De Jong continues her analysis of O'Connor. She is concerned that along with a dividend discount model approach she would also like to get a measure of the contribution that the key managers, Melanie and Arthur O'Connor, have made to the company's apparent ongoing success.

She considers using NOPAT and EVA to assess management performance. She believes that increasing invested capital to take advantage of projects with positive net present values increases both NOPAT and EVA .

However, De Jong decides to use residual income analysis instead. She provides the following justification for using the residual income model:

* The calculation of residual income depends primarily on readily available accounting data.

* The residual income model can be used even when cash flow is difficult to forecast.

* The residual income model does not depend on dividend payments or on positive free cash flows in the near future.

* The residual income model depends on the validity of the clean surplus relation.

She also considers the following assumptions about continuing residual income:

Assumption 1: Residual income is positive and continues at the same level year after year.

Assumption 2: As return on equity approaches the cost of equity, residual income tends to zero.

Assumption 3: Residual income growth declines overtime and eventually reaches zero.

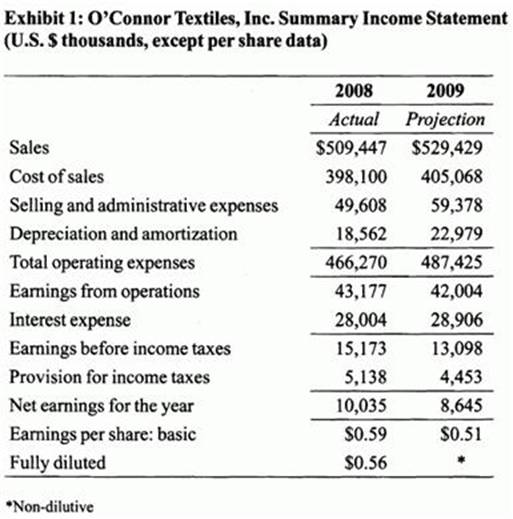

De Jong gathers recent financial information data on O'Connor, as shown in Exhibit I.

De Jong has also determined that at the beginning of 2008, O'Connor had total capital of $324,000,000, of which $251,000,000 was debt and $73,000,000 was equity. The company's cost of debt before taxes is 7%, and the cost of equity capital is 8%. The company has a tax rate of approximately 34%. Weighted average cost of capital is 5.4%. Net operating profit after tax (before any adjustments) is $28,517,640.

De Jong is interested in obtaining the market's assessment of the implied growth rate in residual income and notes that the book value per share for O'Connor at the beginning of 2009 was $4.29, and the current market price is $70. She forecasts the return on equity (ROE) for 2009 to be 11.84%.

De Jong discusses her analyses with a colleague, who makes the following general statements:

Statement 1: It is usually the case that value is recognized later in the residual income model than in the dividend discount model.

Statement 2: When the present value of expected future residual income is

negative, the justified P/B based on fundamentals is less than one.

Which of De Jong's assumptions about continuing residual income is least appropriate!

It is not frequently assumed that the growth rate in residual income declines over time and eventually reaches zero. Instead, it is assumed that the level of residual income declines over time and eventually reaches zero. {Study Session 12, LOS 43.h,i)

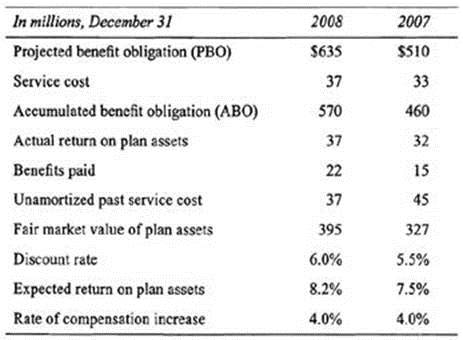

Lauren Jacobs, CFA, is an equity analyst for DF Investments. She is evaluating Iron Parts Inc. Iron Parts is a manufacturer of interior systems and components for automobiles. The company is the world's second largest original equipment auto parts supplier, with a market capitalization of $1.8 billion. Based on Iron Parts's low price-to-book value ratio of 0.9* and low price-to-sales ratio of 0.15x, Jacobs believes the stock could be an interesting investment. However, she wants to review the disclosures found in the company's financial footnotes. In particular, Jacobs is concerned about Iron Parts's defined benefit pension plan. The following information for 2007 and 2008 is provided.

Iron Parts has adopted SFAS No. 158, Employers' Accounting for Defined Benefit Pensions and Other Postretirement Plans.

Jacobs wants to fully understand the impact of changing pension assumptions on Iron Parts's balance sheet and income statement. In addition, she would like to compute Iron Parts's economic pension expense.

As of December 31, 2008, the funded status of Iron Parts's pension plan was:

Funded status equals fair value of plan assets minus PBO (395 - 635 = -240). (Study Session 6, LOS 22.c,f)

Tamara Ogle, CFA, and Isaac Segovia, CAIA, are portfolio managers for Luca's Investment Management (Luca's). Ogle and Segovia both manage large institutional investment portfolios for Luca's and are researching portfolio optimization strategies.

Ogle and Segovia begin by researching the merits of active versus passive portfolio management. Ogle advocates a passive approach, pointing out that on a risk-adjusted basis, most managers cannot beat a passive index strategy. Segovia points out that there will always be a need for active portfolio managers because as prices deviate from fair value, active managers will bring prices back into equilibrium. They determine that Treynor-Black models permit active management within the context of normally efficient markets.

Ogle decides to implement Treynor-Black models in her practice and starts the implementation process. In conversations with her largest client's risk manager, Jim King, FRM, she is asked about separation theorem in relation to active portfolio management. She responds that separation theorem more properly relates to asset prices deviating from and gravitating toward their theoretical fair price. King next asks Ogle about the differences between the Sharpe ratio and the information ratio and the difference between the security market line (SML) and the capital market line (CML).

After reallocating her client portfolios based on using the Treynor-Black model, Ogle discusses the results with Segovia. Ogle states that she is satisfied with the current methodology, but given her preference for passive management, she is still concerned about relying on analyst's forecasts. Segovia tells Ogle that he will research methods for modifying the Treynor-Black model to account for analyst forecasts.

Which of the following is most accurate regarding the separation theorem?

Active portfolio management (generally) and separation theorem (specifically) supports the conclusion that all investors should hold a combination of the risk-free asset and the market portfolio. This allows the portfolio manager to identify the optimal risky portfolio, independent to the investor's risk aversion. The optimal portfolio for an individual investor is a combination of the risk-free asset and the optimal risky asset portfolio that does depend on the investor's degree of risk aversion. (Study Session 18, LOS67.a)

Unlock All Questions for CFA Institute CFA-Level-II Exam

Full Exam Access, Actual Exam Questions, Validated Answers, Anytime Anywhere, No Download Limits, No Practice Limits

Get All 715 Questions & Answers