Most Recent CIPS L5M4 Exam Dumps

Prepare for the CIPS Advanced Contract and Financial Management exam with our extensive collection of questions and answers. These practice Q&A are updated according to the latest syllabus, providing you with the tools needed to review and test your knowledge.

QA4Exam focus on the latest syllabus and exam objectives, our practice Q&A are designed to help you identify key topics and solidify your understanding. By focusing on the core curriculum, These Questions & Answers helps you cover all the essential topics, ensuring you're well-prepared for every section of the exam. Each question comes with a detailed explanation, offering valuable insights and helping you to learn from your mistakes. Whether you're looking to assess your progress or dive deeper into complex topics, our updated Q&A will provide the support you need to confidently approach the CIPS L5M4 exam and achieve success.

The questions for L5M4 were last updated on May 3, 2025.

- Viewing page 1 out of 9 pages.

- Viewing questions 1-5 out of 43 questions

SIMULATION

What are KPIs and why are they used? Give examples.

Key Performance Indicators (KPIs) are quantifiable metrics used to evaluate the success of an organization, project, or individual in meeting predefined objectives. Within the scope of the CIPS L5M4 Advanced Contract and Financial Management module, KPIs play a pivotal role in monitoring and managing contract performance, ensuring financial efficiency, and delivering value for money. They provide a structured framework to assess whether contractual obligations are being fulfilled and whether financial and operational goals are on track. KPIs are used to enhance transparency, foster accountability, support decision-making, and drive continuous improvement by identifying strengths and weaknesses in performance. Below is a detailed step-by-step solution:

Definition of KPIs:

KPIs are specific, measurable indicators that reflect progress toward strategic or operational goals.

They differ from general metrics by being directly tied to critical success factors in a contract or financial context.

Characteristics of Effective KPIs:

Specific: Clearly defined to avoid ambiguity (e.g., 'on-time delivery' rather than 'good service').

Measurable: Quantifiable in numerical terms (e.g., percentage, cost, time).

Achievable: Realistic within the contract's scope and resources.

Relevant: Aligned with the contract's purpose and organizational goals.

Time-bound: Measured within a specific timeframe (e.g., monthly, quarterly).

Why KPIs Are Used:

Performance Monitoring: Track supplier or contractor adherence to agreed terms.

Risk Management: Identify deviations early to mitigate potential issues (e.g., delays or cost overruns).

Financial Control: Ensure budgets are adhered to and cost efficiencies are achieved.

Accountability: Hold parties responsible for meeting agreed standards.

Continuous Improvement: Provide data to refine processes and enhance future contracts.

Examples of KPIs:

Operational KPI: Percentage of On-Time Deliveries -- Measures the supplier's ability to deliver goods or services within agreed timelines (e.g., 98% of shipments delivered on schedule).

Financial KPI: Cost Variance -- Compares actual costs to budgeted costs (e.g., staying within 5% of the allocated budget).

Quality KPI: Defect Rate -- Tracks the proportion of defective items or services (e.g., less than 1% defects in a production batch).

Service KPI: Response Time -- Evaluates how quickly a supplier addresses issues (e.g., resolving complaints within 24 hours).

Sustainability KPI: Carbon Footprint Reduction -- Measures environmental impact (e.g., 10% reduction in emissions from logistics).

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide positions KPIs as a cornerstone of effective contract management. According to the guide, KPIs are 'quantifiable measures that allow organizations to assess supplier performance against contractual obligations and financial targets.' They are not arbitrary metrics but are carefully selected to reflect the contract's priorities, such as cost efficiency, quality, or timely delivery. The guide stresses that KPIs must be agreed upon by all parties during the contract negotiation phase to ensure mutual understanding and commitment.

Detailed Purpose:

Monitoring and Evaluation: Chapter 2 of the study guide explains that KPIs provide 'a systematic approach to monitoring performance,' enabling managers to track progress in real-time and compare it against benchmarks. For example, a KPI like 'percentage of invoices paid on time' ensures financial discipline.

Decision-Making: KPIs offer data-driven insights, allowing contract managers to decide whether to escalate issues, renegotiate terms, or terminate agreements. The guide notes, 'KPIs highlight variances that require corrective action.'

Value for Money: The financial management aspect of L5M4 emphasizes KPIs as tools to ensure contracts deliver economic benefits. For instance, a KPI tracking 'total cost of ownership' helps assess long-term savings beyond initial costs.

Risk Mitigation: By setting thresholds (e.g., maximum acceptable delay), KPIs act as early warning systems, aligning with the guide's focus on proactive risk management.

Practical Application:

The guide provides examples like 'schedule performance index' (SPI), which measures progress against timelines, and 'cost performance index' (CPI), which evaluates budget efficiency. These are often expressed as ratios (e.g., SPI > 1 indicates ahead of schedule).

Another example is 'service level agreements' (SLAs), where KPIs such as 'uptime percentage' (e.g., 99.9% system availability) are critical in IT contracts.

In a procurement context, KPIs like 'supplier lead time' (e.g., goods delivered within 7 days) ensure supply chain reliability.

Why They Matter:

The study guide underscores that KPIs bridge the gap between contract terms and actual outcomes. They transform abstract goals (e.g., 'improve quality') into concrete targets (e.g., 'reduce defects by 15%'). This alignment is vital for achieving strategic objectives, such as cost reduction or customer satisfaction.

KPIs also facilitate stakeholder communication by providing a common language to discuss performance. For instance, a KPI report showing '90% compliance with safety standards' reassures clients and regulators alike.

Broader Implications:

In complex contracts, KPIs may be tiered (e.g., primary KPIs for overall success and secondary KPIs for specific tasks). The guide advises balancing quantitative KPIs (e.g., cost savings) with qualitative ones (e.g., customer feedback scores) to capture a holistic view.

Regular review of KPIs is recommended to adapt to changing circumstances, such as market fluctuations or new regulations, ensuring they remain relevant throughout the contract lifecycle.

CIPS L5M4 Study Guide, Chapter 2: Performance Management in Contracts, Section on Key Performance Indicators.

Additional Reference: Chapter 4: Financial Management in Contracts, Section on Measuring Financial Performance.

SIMULATION

XYZ Ltd is a retail organization that is conducting a competitive benchmarking project. What are the advantages and disadvantages of this? (25 points)

Competitive benchmarking involves XYZ Ltd comparing its performance with a rival retailer. Below are the advantages and disadvantages, explained step-by-step:

Advantages

Identifies Competitive Gaps

Step 1: Comparison

XYZ assesses metrics like pricing, delivery speed, or customer service against a competitor.

Step 2: Outcome

Highlights areas where XYZ lags (e.g., slower delivery), driving targeted improvements.

Benefit:

Enhances market positioning.

Drives Performance Improvement

Step 1: Learning

Adopting best practices from competitors (e.g., efficient inventory management).

Step 2: Outcome

Boosts operational efficiency and customer satisfaction.

Benefit:

Strengthens competitiveness in retail.

Market Insight

Step 1: Analysis

Provides data on industry standards and trends.

Step 2: Outcome

Informs strategic decisions (e.g., pricing adjustments).

Benefit:

Keeps XYZ aligned with market expectations.

Disadvantages

Data Access Challenges

Step 1: Limitation

Competitors may not share detailed performance data.

Step 2: Outcome

Relies on estimates or public info, reducing accuracy.

Drawback:

Limits depth of comparison.

Risk of Imitation Over Innovation

Step 1: Focus

Copying rivals may overshadow unique strategies.

Step 2: Outcome

XYZ might lose differentiation (e.g., unique branding).

Drawback:

Stifles originality.

Resource Intensive

Step 1: Effort

Requires time, staff, and costs to gather and analyze data.

Step 2: Outcome

Diverts resources from other priorities.

Drawback:

May strain operational capacity.

Exact Extract Explanation:

The CIPS L5M4 Study Guide discusses competitive benchmarking:

Advantages: 'It identifies gaps, improves performance, and provides market insights' (CIPS L5M4 Study Guide, Chapter 2, Section 2.6).

Disadvantages: 'Challenges include limited data access, potential over-reliance on imitation, and high resource demands' (CIPS L5M4 Study Guide, Chapter 2, Section 2.6).

This is key for retail procurement and financial strategy. Reference: CIPS L5M4 Study Guide, Chapter 2: Supply Chain Performance Management.

SIMULATION

Describe the SERVQUAL model that can be used to assess quality in the service industry (15 points). What are the advantages of using the model? (10 points)

Part 1: Description of the SERVQUAL Model (15 points)

Step 1: Define the Model

SERVQUAL is a framework to measure service quality by comparing customer expectations with their perceptions of actual service received.

Step 2: Key Components

It uses five dimensions to assess quality:

Tangibles: Physical aspects (e.g., facilities, equipment, staff appearance).

Reliability: Delivering promised services dependably and accurately.

Responsiveness: Willingness to help customers and provide prompt service.

Assurance: Knowledge and courtesy of staff, inspiring trust.

Empathy: Caring, individualized attention to customers.

Step 3: Application

Customers rate expectations and perceptions on a scale (e.g., 1-7), and gaps between the two highlight areas for improvement.

Outcome:

Identifies service quality deficiencies for targeted enhancements.

Part 2: Advantages of Using the SERVQUAL Model (10 points)

Step 1: Customer-Centric Insight

Focuses on customer perceptions, aligning services with their needs.

Step 2: Gap Identification

Pinpoints specific weaknesses (e.g., low responsiveness), enabling precise action.

Step 3: Benchmarking

Allows comparison over time or against competitors to track progress.

Outcome:

Enhances service delivery and competitiveness in the service industry.

Exact Extract Explanation:

SERVQUAL Description: The CIPS L5M4 Study Guide notes, 'SERVQUAL assesses service quality through five dimensions---tangibles, reliability, responsiveness, assurance, and empathy---by measuring gaps between expectation and performance' (CIPS L5M4 Study Guide, Chapter 2, Section 2.5).

Advantages: It states, 'The model's strengths include its focus on customer perspectives, ability to identify service gaps, and utility as a benchmarking tool' (CIPS L5M4 Study Guide, Chapter 2, Section 2.5).

This is vital for service-based procurement and contract management. Reference: CIPS L5M4 Study Guide, Chapter 2: Supply Chain Performance Management.

SIMULATION

Describe 5 parts of the analysis model, first put forward by Porter, in which an organisation can assess the competitive marketplace (25 marks)

The analysis model referred to in the question is Porter's Five Forces, a framework developed by Michael Porter to assess the competitive environment of an industry and understand the forces that influence an organization's ability to compete effectively. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, Porter's Five Forces is a strategic tool used to analyze the marketplace to inform procurement decisions, supplier selection, and contract strategies, ensuring financial and operational efficiency. Below are the five parts of the model, explained in detail:

Threat of New Entrants:

Description: This force examines how easy or difficult it is for new competitors to enter the market. Barriers to entry (e.g., high capital requirements, brand loyalty, regulatory restrictions) determine the threat level.

Impact: High barriers protect existing players, while low barriers increase competition, potentially driving down prices and margins.

Example: In the pharmaceutical industry, high R&D costs and strict regulations deter new entrants, reducing the threat.

Bargaining Power of Suppliers:

Description: This force assesses the influence suppliers have over the industry, based on their number, uniqueness of offerings, and switching costs for buyers.

Impact: Powerful suppliers can increase prices or reduce quality, squeezing buyer profitability.

Example: In the automotive industry, a limited number of specialized steel suppliers may have high bargaining power, impacting car manufacturers' costs.

Bargaining Power of Buyers:

Description: This force evaluates the influence buyers (customers) have on the industry, determined by their number, purchase volume, and ability to switch to alternatives.

Impact: Strong buyer power can force price reductions or demand higher quality, reducing profitability.

Example: In retail, large buyers like supermarkets can negotiate lower prices from suppliers due to their high purchase volumes.

Threat of Substitute Products or Services:

Description: This force analyzes the likelihood of customers switching to alternative products or services that meet the same need, based on price, performance, or availability.

Impact: A high threat of substitutes limits pricing power and profitability.

Example: In the beverage industry, the rise of plant-based milk (e.g., almond milk) poses a substitute threat to traditional dairy milk.

Competitive Rivalry within the Industry:

Description: This force examines the intensity of competition among existing firms, influenced by the number of competitors, market growth, and product differentiation.

Impact: High rivalry leads to price wars, increased marketing costs, or innovation pressures, reducing profitability.

Example: In the smartphone industry, intense rivalry between Apple and Samsung drives innovation but also squeezes margins through competitive pricing.

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide explicitly references Porter's Five Forces as a tool for 'analyzing the competitive environment' to inform procurement and contract strategies. It is presented in the context of market analysis, helping organizations understand external pressures that impact supplier relationships, pricing, and financial outcomes. The guide emphasizes its relevance in strategic sourcing (as in Question 11) and risk management, ensuring buyers can negotiate better contracts and achieve value for money.

Detailed Explanation of Each Force:

Threat of New Entrants:

The guide notes that 'barriers to entry influence market dynamics.' For procurement, a low threat (e.g., due to high entry costs) means fewer suppliers, potentially increasing supplier power and costs. A buyer might use this insight to secure long-term contracts with existing suppliers to lock in favorable terms.

Bargaining Power of Suppliers:

Chapter 2 highlights that 'supplier power affects cost structures.' In L5M4, this is critical for financial management---high supplier power (e.g., few suppliers of a rare material) can inflate costs, requiring buyers to diversify their supply base or negotiate harder.

Bargaining Power of Buyers:

The guide explains that 'buyer power impacts pricing and margins.' For a manufacturer like XYZ Ltd (Question 7), strong buyer power from large clients might force them to source cheaper raw materials, affecting supplier selection.

Threat of Substitute Products or Services:

L5M4's risk management section notes that 'substitutes can disrupt supply chains.' A high threat (e.g., synthetic alternatives to natural materials) might push a buyer to collaborate with suppliers on innovation to stay competitive.

Competitive Rivalry within the Industry:

The guide states that 'rivalry drives market behavior.' High competition might lead to price wars, prompting buyers to seek cost efficiencies through strategic sourcing or supplier development (Questions 3 and 11).

Application in Contract Management:

Porter's Five Forces helps buyers assess the marketplace before entering contracts. For example, if supplier power is high (few suppliers), a buyer might negotiate longer-term contracts to secure supply. If rivalry is intense, they might prioritize suppliers offering innovation to differentiate their products.

Financially, understanding these forces ensures cost control---e.g., mitigating supplier power reduces cost inflation, aligning with L5M4's focus on value for money.

Practical Example for XYZ Ltd (Question 7):

Threat of New Entrants: Low, due to high setup costs for raw material production, giving XYZ Ltd fewer supplier options.

Supplier Power: High, if raw materials are scarce, requiring XYZ Ltd to build strong supplier relationships.

Buyer Power: Moderate, as XYZ Ltd's clients may have alternatives, pushing for competitive pricing.

Substitutes: Low, if raw materials are specialized, but XYZ Ltd should monitor emerging alternatives.

Rivalry: High, in manufacturing, so XYZ Ltd must source efficiently to maintain margins.

This analysis informs XYZ Ltd's supplier selection and contract terms, ensuring financial and operational resilience.

Broader Implications:

The guide advises using Porter's Five Forces alongside other tools (e.g., SWOT analysis) for a comprehensive market view. It also stresses that these forces are dynamic---e.g., new regulations might lower entry barriers, increasing competition over time.

In financial management, the model helps buyers anticipate cost pressures (e.g., from supplier power) and negotiate contracts that mitigate risks, ensuring long-term profitability.

CIPS L5M4 Study Guide, Chapter 2: Performance Management in Contracts, Section on Market Analysis and Competitive Environment.

Additional Reference: Chapter 4: Financial Management in Contracts, Section on Risk Management and Cost Control.

SIMULATION

John is looking at the potential of three different projects and is considering the Return on Investment. What is meant by this, and what are the benefits and disadvantages of using this method? Which option should he choose? (25 marks)

Part 1: What is meant by Return on Investment (ROI)? (8 marks)

Return on Investment (ROI) is a financial metric used to evaluate the efficiency or profitability of an investment by measuring the return generated relative to its cost. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, ROI is a key tool for assessing the financial viability of projects or contracts, ensuring they deliver value for money. Below is a step-by-step explanation:

Definition:

Net Profit = Total Returns -- Investment Cost.

Purpose:

It helps decision-makers like John compare the financial benefits of projects against their costs.

Example: A project costing 100k that generates 120k in returns has an ROI of 20%.

Part 2: Benefits and Disadvantages of Using ROI (10 marks)

Benefits:

Simplicity and Clarity:

ROI is easy to calculate and understand, providing a straightforward percentage to compare options.

Example: John can quickly see which project yields the highest return.

Focus on Financial Efficiency:

It aligns with L5M4's emphasis on value for money by highlighting projects that maximize returns.

Example: A higher ROI indicates better use of financial resources.

Comparability:

Allows comparison across different projects or investments, regardless of scale.

Example: John can compare projects with different investment amounts.

Disadvantages:

Ignores Time Value of Money:

ROI does not account for when returns are received, which can skew long-term project evaluations.

Example: A project with returns in Year 3 may be less valuable than one with returns in Year 1.

Excludes Non-Financial Factors:

It overlooks qualitative benefits like quality improvements or strategic alignment.

Example: A project with a lower ROI might offer sustainability benefits.

Potential for Misleading Results:

ROI can be manipulated by adjusting cost or profit definitions, leading to inaccurate comparisons.

Example: Excluding hidden costs (e.g., maintenance) inflates ROI.

Part 3: Which Option Should John Choose? (7 marks)

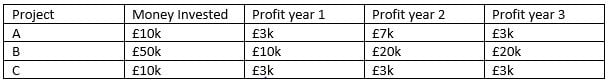

Using the data provided for the three projects, let's calculate the ROI for each to determine the best option for John. The table is as follows:

Step 1: Calculate Total Profit for Each Project:

Project A: 3k (Year 1) + 3k (Year 2) + 3k (Year 3) = 9k

Project B: 3k (Year 1) + 3k (Year 2) + 3k (Year 3) = 9k

Project C: 3k (Year 1) + 3k (Year 2) + 3k (Year 3) = 9k

Step 2: Calculate Net Profit (Total Profit -- Investment):

Project A: 9k -- 10k = -1k (a loss)

Project B: 9k -- 50k = -41k (a loss)

Project C: 9k -- 10k = -1k (a loss)

Step 3: Calculate ROI for Each Project:

Step 4: Compare and Choose:

Project A: -10% ROI

Project B: -82% ROI

Project C: -10% ROI

All projects show a negative ROI, meaning none generate a profit over the investment cost. However, Projects A and C have the least negative ROI at -10%, while Project B is significantly worse at -82%. Between A and C, the ROI is identical, but both require the same investment (10k) and yield the same returns. Therefore, there is no financial difference between A and C based on ROI alone. However, since the question asks for a choice, John should choose either Project A or Project C over Project B, as they minimize losses. Without additional qualitative factors (e.g., strategic fit, risk), either A or C is equally viable. For simplicity, let's recommend Project A.

Recommendation: John should choose Project A (or C), as it has a less negative ROI (-10%) compared to Project B (-82%), indicating a smaller financial loss.

Exact Extract Explanation:

Part 1: What is Return on Investment?

The CIPS L5M4 Advanced Contract and Financial Management study guide explicitly covers ROI in the context of financial management tools for evaluating contract or project performance. It defines ROI as 'a measure of the gain or loss generated on an investment relative to the amount invested,' typically expressed as a percentage. The guide positions ROI as a fundamental metric for assessing 'value for money,' a core principle of L5M4, especially when selecting projects or suppliers.

Detailed Explanation:

The guide explains that ROI is widely used because it provides a 'clear financial snapshot' of investment performance. In John's case, ROI helps compare the profitability of three projects.

It also notes that ROI is often used in contract management to evaluate supplier performance or project outcomes, ensuring resources are allocated efficiently.

Part 2: Benefits and Disadvantages

The study guide discusses ROI's role in financial decision-making, highlighting its strengths and limitations, particularly in contract and project evaluations.

Benefits:

Simplicity and Clarity:

Chapter 4 notes that ROI's 'ease of calculation' makes it accessible for quick assessments, ideal for John's scenario.

Focus on Financial Efficiency:

The guide emphasizes ROI's alignment with 'maximizing returns,' ensuring investments like John's projects deliver financial value.

Comparability:

ROI's percentage format allows 'cross-project comparisons,' per the guide, enabling John to evaluate projects with different investment levels.

Disadvantages:

Ignores Time Value of Money:

The guide warns that ROI 'does not consider the timing of cash flows,' a critical limitation. For John, returns in Year 3 are less valuable than in Year 1 due to inflation or opportunity costs.

Excludes Non-Financial Factors:

L5M4 stresses that financial metrics alone can miss 'strategic benefits' like quality or innovation, which might apply to John's projects.

Potential for Misleading Results:

The guide cautions that ROI can be 'distorted' if costs or profits are misreported, a risk John should consider if project data is incomplete.

Part 3: Which Option Should John Choose?

The guide's focus on ROI as a decision-making tool directly supports the calculation process above. It advises using ROI to 'rank investment options' but also to consider broader factors if results are close, as seen with Projects A and C.

Analysis:

The negative ROIs indicate all projects are unprofitable, a scenario the guide acknowledges can occur, suggesting further analysis (e.g., risk, strategic fit). However, based solely on ROI, A and C are better than B.

The guide's emphasis on minimizing financial loss in poor-performing investments supports choosing A or C, as they have the least negative impact.

CIPS L5M4 Study Guide, Chapter 4: Financial Management in Contracts, Section on Financial Metrics and Investment Appraisal.

Additional Reference: Chapter 2: Performance Management in Contracts, Section on Decision-Making Tools.

Unlock All Questions for CIPS L5M4 Exam

Full Exam Access, Actual Exam Questions, Validated Answers, Anytime Anywhere, No Download Limits, No Practice Limits

Get All 43 Questions & Answers